How can Calforex save you money when remitting abroad?

posted in Calforex Blog, Corporate News, Homepage

When sending currency abroad, a term encapsulates all internal processes undertaken by Money service businesses or banks to send and exchange currency abroad, namely, a wire. So how does a wire actually work?

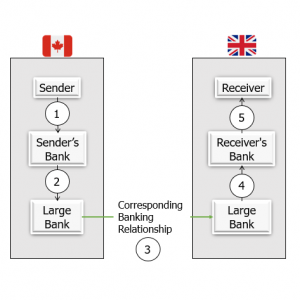

International payments rely on both domestic payment rails and the interaction between banks in different jurisdictions. The banking network is essentially a decentralized network of communication rails between small domestic banks and more significant international banks. Here is a simplified example of what a remittance from Canada to the UK might look like.

- The sender decides to remit funds from Canada to the United Kingdom. The bank debits their account by the amount they want to send and deducts their fees from this total.

- The sender’s bank uses the local payment network, Electronic Funds Transfer (EFT) in Canada, to send the funds to a large bank with corresponding international banking relationships.

- The large bank orchestrates the international flow of funds with its UK corresponding bank; it also charges a fee for performing this task.

- The UK bank then transfers funds to the receiver’s bank via local payment rails, which is CHAPS in the UK and again, charges a fee for facilitating this.

- Receivers bank credits the Receivers bank account.

In essence, wires don’t really exist; moreover, the process is just a bunch of transactions between communicating banks. The medium frequently used for communication is the Society for Worldwide Interbank Financial Telecommunication (SWIFT).

The above process clearly omits an integral part of the transaction, the foreign exchange! The foreign exchange is completed in our diagram by either of the UK banks. The consensus is that banks charge ~3.5% of the total value per international payment.

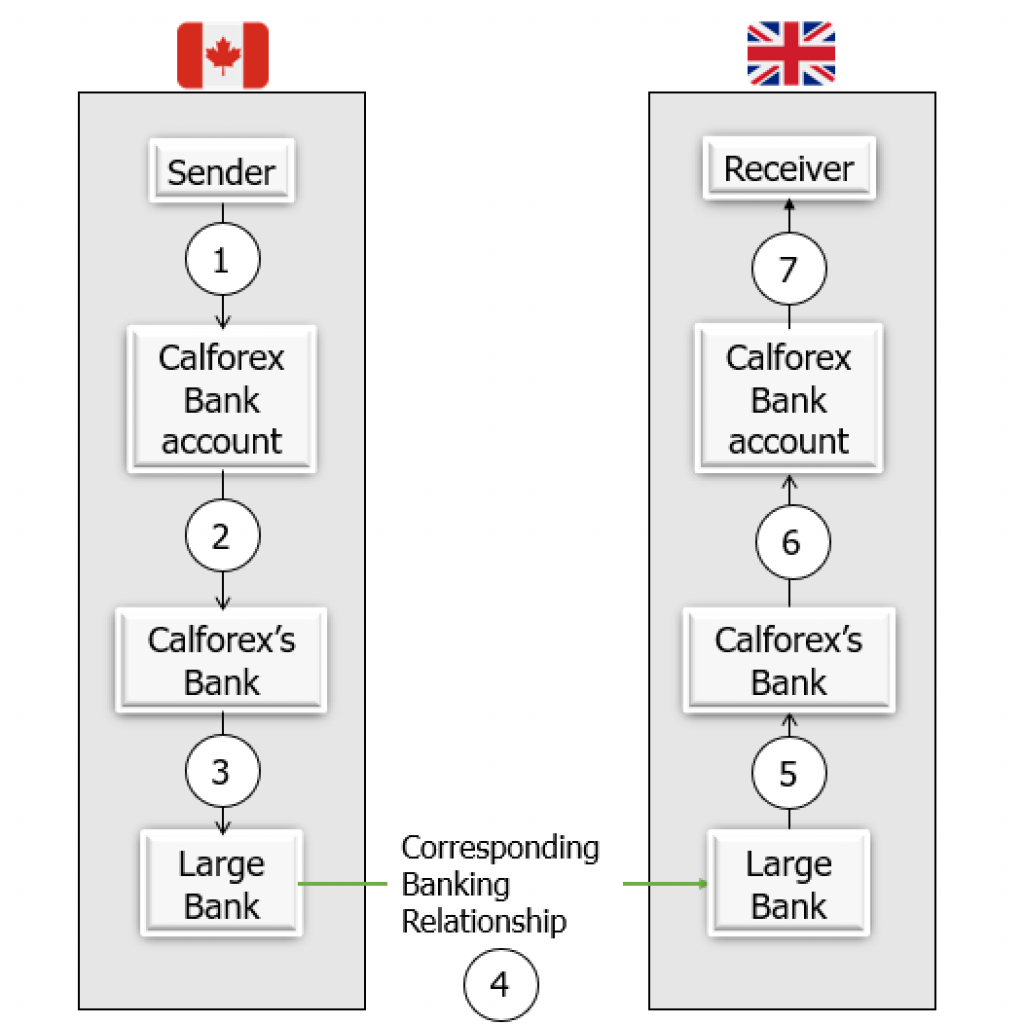

How does Calforex charge such low fees?

If we compare the same transaction, but now with the addition of a money service business like Calforex.

Calforex has an array of bank accounts denominated in different currencies. By purchasing foreign currencies from our liquidity providers at wholesale prices, we can convert currency at a much more competitive rate, saving you from hefty bank charges.

For more info on how to send a wire, please Contact Us or visit our International Wires page